Paul Tudor Jones Recommended Books

American hedge fund manager and investor

5 Books Recommended

New chapter by Soros on the secrets to his success along with a new Preface and Introduction. New Foreword by renowned economist Paul Volcker "An extraordinary . . . inside look into the decision-making process of the most successful money manager of our time. Fantastic."― The Wall Street Journal George Soros is unquestionably one of the most powerful and profitable investors in the world today. Dubbed by BusinessWeek as "the Man who Moves Markets," Soros made a fortune competing with the British pound and remains active today in the global financial community. Now, in this special edition of the classic investment book, The Alchemy of Finance, Soros presents a theoretical and practical account of current financial trends and a new paradigm by which to understand the financial market today. This edition's expanded and revised Introduction details Soros's innovative investment practices along with his views of the world and world order. He also describes a new paradigm for the "theory of reflexivity" which underlies his unique investment strategies. Filled with expert advice and valuable business lessons, The Alchemy of Finance reveals the timeless principles of an investing legend. This special edition will feature a new chapter by Soros on the secrets of his success and a new Foreword by the Honorable Paul Volcker, former Chairman of the Federal Reserve. George Soros (New York, NY) is President of Soros Fund Management and Chief Investment Advisor to Quantum Fund N.V., a $12 billion international investment fund. Besides his numerous ventures in finance, Soros is also extremely active in the worlds of education, culture, and economic aid and development through his Open Society Fund and the Soros Foundation.

Trader Vic -- Methods of a Wall Street Master Investment strategies from the man Barron's calls "The Ultimate Wall Street Pro" "Victor Sperandeo is gifted with one of the finest minds I know. No wonder he's compiled such an amazing record of success as a money manager. Every investor can benefit from the wisdom he offers in his new book. Don't miss it!" --Paul Tudor Jones Tudor Investment Corporation "Here's a simple review in three steps: 1. Buy this book! 2. Read this book! 3. See step 2. For those who can't take a hint, Victor Sperandeo with T. Sullivan Brown has written a gem, a book of value for everyone in the markets, whether egghead, novice or seasoned speculator." --John Sweeney Technical Analysis of Stocks and Commodities "Get Trader Vic-Methods of a Wall Street Master by Victor Sperandeo, read it over and over and you'll never have a losing year again." --Yale Hirsch Smart Money "I have followed Victor Sperandeo's advice for ten years, and the results have been outstanding. This book is a must for any serious investor." --James J. Hayes, Vice President, Investments Prudential Securities Inc. "This book covers all the important aspects of making money and integrates them into a unifying philosophy that includes economics, Federal Reserve policy, trading methods, risk, psychology, and more. It's a philosophy everyone should understand." --T. Boone Pickens, General Partner Mesa Limited Partnership "This book gave me a wealth of new insights into trading. Whether you're a short-term trader or a long-term investor, you will improve your performance by following Sperandeo's precepts." --Louis I. Margolis Managing Director, Salomon Brothers, Inc.

The Dao of Capital: Austrian Investing in a Distorted World

by Mark Spitznagel

Rating: 4.0 ⭐

• 8 recommendations ❤️

As today's preeminent doomsday investor Mark Spitznagel describes his Daoist and roundabout investment approach, “one gains by losing and loses by gaining.” This is Austrian Investing , an archetypal, counterintuitive, and proven approach, gleaned from the 150-year-old Austrian School of economics, that is both timeless and exceedingly timely. In The Dao of Capital , hedge fund manager and tail-hedging pioneer Mark Spitznagel―with one of the top returns on capital of the financial crisis, as well as over a career―takes us on a gripping, circuitous journey from the Chicago trading pits, over the coniferous boreal forests and canonical strategists from Warring States China to Napoleonic Europe to burgeoning industrial America, to the great economic thinkers of late 19th century Austria. We arrive at his central investment methodology of Austrian Investing , where victory comes not from waging the immediate decisive battle, but rather from the roundabout approach of seeking the intermediate positional advantage (what he calls shi ), of aiming at the indirect means rather than directly at the ends. The monumental challenge is in seeing time differently, in a whole new intertemporal dimension, one that is so contrary to our wiring. Spitznagel is the first to condense the theories of Ludwig von Mises and his Austrian School of economics into a cohesive and―as Spitznagel has shown―highly effective investment methodology. From identifying the monetary distortions and non-randomness of stock market routs (Spitznagel's bread and butter) to scorned highly-productive assets, in Ron Paul's words from the foreword, Spitznagel “brings Austrian economics from the ivory tower to the investment portfolio.” The Dao of Capital provides a rare and accessible look through the lens of one of today's great investors to discover a profound harmony with the market process―a harmony that is so essential today.

Jesse Livermore - Boy Plunger: The Man Who Sold America Short in 1929

by Tom Rubython

Rating: 4.5 ⭐

• 2 recommendations ❤️

Livermore went bankrupt for at least the fourth time in 1934. Despite having amassed a fortune of $100 million by1929, Livermore was back where he started at 16. He did not seem to learn from hismistakes."—Victor Niederhoffer"That was the call of a lifetime, everyone was blind and deep into the crisis and Jesse Livermoremade $100 million going short when almost everyone else was bullish and then almost everyone else lost their shirts."—John Paulson"His stories of making millions, were the financial equivalent of “sex, drugs and rock ‘n roll” to ayoung man at the advent of his financial career."—Paul Tudor Jones"It was an amazing day on 24th October 1929 when Jesse came home and hiswife thought they were ruined and instead he had the second best trading dayof anyone in history."—John TempletonWho was Jesse Livermore?Jesse Livermore, was the most successful stock and commoditiestrader that ever operated on the stock markets. He was both theman who made the most money in a single day and the man wholost the most money in a single day. In fact he made and lost threegreat fortunes between 1900 and 1940.Singlehandedly he caused the two great Wall Street crashes of1907 and 1929, making millions from both. When he speculated hespeculated big and was known on Wall Street as the Boy Plunger.For a brief period in the early 1930s he was one of the world’srichest men with a personal fortune believed to be worth over$150 million, $100 million of that earned in just a few days fromthe Wall Street crash of 1929. In the end it was too extreme achange of fortunes for any man to cope with and Livermore shothimself in a New York hotel lobby in 1940 aged just 63. His legacycontinued and his son, Jesse jr later also committed suicide asdid his grandson, Jesse III.In the summer of 1929 most people believed that the stock market wouldcontinue to rise forever. Wall Street was enjoying a eight-year winning runthat had seen the Dow Jones increase 1,000 per cent from the start ofthe decade - an unprecedented rise. The Dow peaked at 381 on 3rdSeptember and later that day the most respected economist of the day,Irving Fisher, declared that the rise was “permanent”. One man vigorouslydisagreed and sold $300 million worth of shares short. Two weeks later themarket began falling and rising again on successive days for no apparentreason. This situation endured for a month until what became famouslyknown as the three ‘black’ On Black Thursday 24th October the Dowfell 11% at the opening bell, prompting absolute chaos. The fall was stalledwhen leading financiers of the day clubbed together to buy huge quantitiesof shares. But it was short-lived succor and over that weekend blanketnegative newspaper commentary caused the second of the ‘black’ dayson Black Monday 26th October when the market dropped another 13%.The third ‘black’ day, Black Tuesday 29th October saw the market drop afurther 12%. When the dust had settled, between the 24th and 29th October,Wall Street had lost $30 billion. Only much later did it became knownthat the man who had sold short $300 million worth of shares was JesseLivermore. Livermore had made $100 million and overnight became oneof the richest men in the world. It remains, adjusted for inflation, the mostmoney ever made by any individual in a period of seven days. This is thestory of that man.

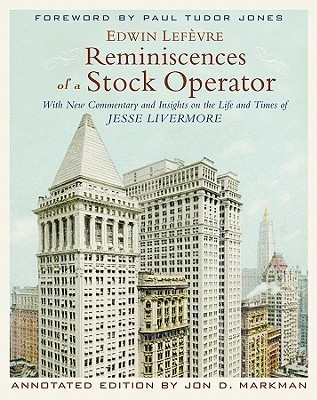

Reminiscences of a Stock Operator: With New Commentary and Insights on the Life and Times of Jesse Livermore

by Edwin Lefèvre

Rating: 4.5 ⭐

• 6 recommendations ❤️

Book annotation not available for this Reminiscences of a Stock Lefevre, Edwin/ Markman, Jon John Wiley & Sons IncPublication 2009/12/21Number of 423Binding HARDCOVERLibrary of 2009042600