Ron Lieber

11 Books Written

The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous, and Smart About Money

by Ron Lieber

Rating: 3.9 ⭐

• 2 recommendations ❤️

New York Times Bestseller “We all want to raise children with good values—children who are the opposite of spoiled—yet we often neglect to talk to our children about money. . . . From handling the tooth fairy, to tips on allowance, chores, charity, checking accounts, and part-time jobs, this engaging and important book is a must-read for parents.” — Gretchen Rubin, author of The Happiness Project In the spirit of Wendy Mogel’s The Blessing of a Skinned Knee and Po Bronson and Ashley Merryman’s Nurture Shock, New York Times “Your Money” columnist Ron Lieber delivers a taboo-shattering manifesto that explains how talking openly to children about money can help parents raise modest, patient, grounded young adults who are financially wise beyond their years. For Ron Lieber, a personal finance columnist and father, good parenting means talking about money with our kids. Children are hyper-aware of money, and they have scores of questions about its nuances. But when parents shy away from the topic, they lose a tremendous opportunity—not just to model the basic financial behaviors that are increasingly important for young adults but also to imprint lessons about what the family truly values. Written in a warm, accessible voice, grounded in real-world experience and stories from families with a range of incomes, The Opposite of Spoiled is both a practical guidebook and a values-based philosophy. The foundation of the book is a detailed blueprint for the best ways to handle the basics: the tooth fairy, allowance, chores, charity, saving, birthdays, holidays, cell phones, checking accounts, clothing, cars, part-time jobs, and college tuition. It identifies a set of traits and virtues that embody the opposite of spoiled, and shares how to embrace the topic of money to help parents raise kids who are more generous and less materialistic. But The Opposite of Spoiled is also a promise to our kids that we will make them better with money than we are. It is for all of the parents who know that honest conversations about money with their curious children can help them become more patient and prudent, but who don’t know how and when to start.

The Price You Pay for College: An Entirely New Road Map for the Biggest Financial Decision Your Family Will Ever Make

by Ron Lieber

Rating: 4.1 ⭐

Named one of the best books of 2021 by NPR New York Times Bestseller and a New York Times Book Review Editor’s Choice pick “Masterly . . .represents an extraordinary achievement: It is comprehensive and detailed without being tedious, practical without being banal, impeccably well judged and unusually rigorous.”—Daniel Markovits, New York Times Book Review “Ron Lieber is a gift.”—Scott Galloway The hugely popular New York Times Your Money columnist and author of the bestselling The Opposite of Spoiled offers a deeply reported and emotionally honest approach to the biggest financial decision families will ever make: what to pay for college—a decision made even more confusing because of the Covid-19 pandemic. Sending a teenager to a flagship state university for four years of on-campus living costs more than $100,000 in many parts of the United States. Meanwhile, many families of freshmen attending selective private colleges will spend triple—over $300,000. With the same passion, smarts, and humor that infuse his personal finance column, Ron Lieber offers a much-needed roadmap to help families navigate this difficult and often confusing journey. Lieber begins by explaining who pays what and why and how the financial aid system got so complicated. He also pulls the curtain back on merit aid, an entirely new form of discounting that most colleges now use to compete with peers. While price is essential, value is paramount. So what is worth paying extra for, and how do you know when it exists in abundance at any particular school? Is a small college better than a big one? Who actually does the teaching? Given that every college claims to have reinvented its career center, who should we actually believe? He asks the tough questions of college presidents and financial aid gatekeepers that parents don’t know (or are afraid) to ask and summarizes the research about what matters and what doesn’t. Finally, Lieber calmly walks families through the process of setting financial goals, explaining the system to their children and figuring out the right ways to save, borrow, and bargain for a better deal. The Price You Pay for College gives parents the clarity they need to make informed choices and helps restore the joy and wonder the college experience is supposed to represent.

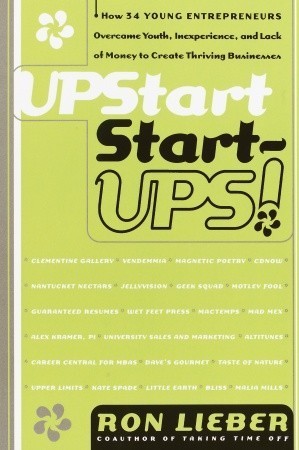

Upstart Start-Ups!: How 34 Young Entrepreneurs Overcame Youth, Inexperience, and Lack of Money to Create Thriving Businesses

by Ron Lieber

Rating: 3.3 ⭐

You're young and ambitious, with a great idea for a new software program, downtown music 'zine, or a better-than-Snapple beverage--but how do you turn your dream concept into a thriving business?Forget the ultra-conservative suits who scoffed when you brought your hot idea to their door! As Fortune magazine's Ron Lieber shows, you can actually turn your youth, inexperience, and lack of money to your advantage and capitalize on your assets to trump the corporate system, be your own boss, and turn your entrepreneurial vision into a reality.Based on interviews with more than thirty young, independent entrepreneurs who have developed some of today's hottest--even revolutionary--companies and products, Upstart Start-Ups! provides essential tips and information that will enable you to get your own Nantucket Nectars or Magnetic Poetry off the ground. Check The myths and realities you need to know about starting a business when you're under 30How to generate your first "brainstorm" and how to act on a good ideaHow to overcome the stigmas of youth and inexperience and make your age work to your advantageHow to develop a realistic business planWhere and how to get the financial backing you needHow to establish credibility for your business or product with consumersModels that have proved successful, and how to apply them to your own visionTwenty-six-year-old Ron Lieber writes for Fortune magazine and is the coauthor of the New York Times business bestseller Taking Time Off. He appears regularly on national television and radio to discuss career issues, corporate management, and his recent columns.

Die Verwöhn-Falle: Wie man seine Kinder zu verantwortungsbewussten und glücklichen Menschen erzieht

by Ron Lieber

Alles dreht sich ums Geld, fast alles. Von klein auf. Das merken die Kinder schnell. Aber natürlich ohne zu wissen, warum, und dass Geld zu haben alles andere als selbstverständlich ist.Daher ist es nie zu früh, der Illusion vorzubeugen, Geld sei einfach sei es für Essen, Wohnung oder Kleidung, sei es für Extra-Wünsche wie Playstation oder Smartphone. Daher plädiert Ron Lieber, Finanzkolumnist und Vater, in seinem nun ins Deutsche übersetzten Bestseller, das Thema Geld rechtzeitig, altersgerecht, fortwährend und ganz natürlich zu behandeln.Kinder heutzutage müssen vor allem praktisch verstehen und erfahren, dass Bedürfnisse sich nicht von selbst befriedigen. Ein paar Handgriffe im Haushalt sind nicht zu viel verlangt und ein Ferienjob keine Zumutung. Lieber entwickelt am Beispiel von gelungenen und weniger gelungenen Vorgehensweisen verschiedener Familien einen Elternleitfaden, mit dessen Hilfe man Belohnungen, Taschengeld, Geschenke und offene Wünsche vernünftig ausbalancieren kann.Die Verwöhn-Falle ist das Präventionsprogramm gegen verwöhnten Nachwuchs und der perfekte Erziehungsratgeber, wie Kinder den Wert des Geldes schätzen lernen und gleichzeitig erkennen, dass es nicht alles ist im Leben.

The Opposite of Spoiled

by Ron Lieber

The Price You Pay for College: An Entirely New Roadmap for the Biggest Financial Decision Your Family Will Ever Make

by Ron Lieber

The hugely popular New York Times “Your Money” columnist and author of the bestselling The Opposite of Spoiled offers a deeply reported and emotionally honest approach to the biggest financial decision families will ever what to pay for college. Sending a teenager to a flagship state university for four years of on-campus living costs more than $100,000 in many parts of the United States. Meanwhile, many families of freshmen attending selective private colleges will spend triple—over $300,000. With the same passion, smarts, and humor that infuse his personal finance column, Ron Lieber offers a much-needed roadmap to help families navigate this difficult and often confusing journey.Lieber begins by explaining who pays what and why and how the financial aid system got so complicated. He also pulls the curtain back on merit aid, an entirely new form of discounting that most colleges now use to compete with peers.While price is essential, value is paramount. So what is worth paying extra for, and how do you know when it exists in abundance at any particular school? Is a small college better than a big one? Who actually does the teaching? Given that every college claims to have reinvented its career center, who should we actually believe? He asks the tough questions of college presidents and financial aid gatekeepers that parents don’t know (or are afraid) to ask and summarizes the research about what matters and what doesn’t.Finally, Lieber calmly walks families through the process of setting financial goals, explaining the system to their children and figuring out the right ways to save, borrow, and bargain for a better deal.The Price You Pay for College gives parents the clarity they need to make informed choices and helps restore the joy and wonder the college experience is supposed to represent.Supplemental enhancement PDF accompanies the audiobook.

The Opposite of Spoiled: Raising Kids Who are Grounded, Generous, and Smart About Money

by Ron Lieber

The Price You Pay for College: An Entirely New Road Map for the Biggest Financial Decision Your Family Will Ever Make

by Ron Lieber

The Price You Pay for An Entirely New Road Map for the Biggest Financial Decision Your Family Will Ever Make. Professionally spiraled and resold by a third party. This spiraled book is not necessarily affiliated with, endorsed by, or authorized by the publisher, distributor, or author.