Emanuel Derman

Emanuel Derman (born c. 1945) is a Jewish South African-born academic, businessman and writer. He is best known as a quantitative analyst, and author of the book My Life as a Quant: Reflections on Physics and Finance

13 Books Written

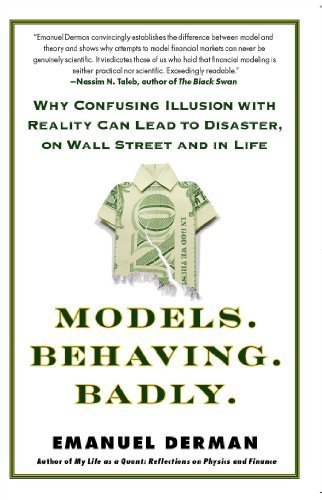

Models.Behaving.Badly.: Why Confusing Illusion with Reality Can Lead to Disaster, on Wall Street and in Life

by Emanuel Derman

Rating: 3.5 ⭐

• 2 recommendations ❤️

Now in paperback, “a compelling, accessible, and provocative piece of work that forces us to question many of our assumptions” (Gillian Tett, author of Fool’s Gold ).Q uants, physicists working on Wall Street as quantitative analysts, have been widely blamed for triggering financial crises with their complex mathematical models. Their formulas were meant to allow Wall Street to prosper without risk. But in this penetrating insider’s look at the recent economic collapse, Emanuel Derman—former head quant at Goldman Sachs—explains the collision between mathematical modeling and economics and what makes financial models so dangerous. Though such models imitate the style of physics and employ the language of mathematics, theories in physics aim for a description of reality—but in finance, models can shoot only for a very limited approximation of reality. Derman uses his firsthand experience in financial theory and practice to explain the complicated tangles that have paralyzed the economy. Models.Behaving.Badly. exposes Wall Street’s love affair with models, and shows us why nobody will ever be able to write a model that can encapsulate human behavior.

In My Life as a Quant, Emanuel Derman relives his exciting journey as one of the first high-energy particle physicists to migrate to Wall Street. Page by page, Derman details his adventures in this field—analyzing the incompatible personas of traders and quants, and discussing the dissimilar nature of knowledge in physics and finance. Throughout this tale, he also reflects on the appropriate way to apply the refined methods of physics to the hurly-burly world of markets.

The Volatility SmileThe Black-Scholes-Merton option model was the greatest innovation of 20th century finance, and remains the most widely applied theory in all of finance. Despite this success, the model is fundamentally at odds with the observed behavior of option a graph of implied volatilities against strike will typically display a curve or skew, which practitioners refer to as the smile, and which the model cannot explain. Option valuation is not a solved problem, and the past forty years have witnessed an abundance of new models that try to reconcile theory with markets.The Volatility Smile presents a unified treatment of the Black-Scholes-Merton model and the more advanced models that have replaced it. It is also a book about the principles of financial valuation and how to apply them. Celebrated author and quant Emanuel Derman and Michael B. Miller explain not just the mathematics but the ideas behind the models. By examining the foundations, the implementation, and the pros and cons of various models, and by carefully exploring their derivations and their assumptions, readers will learn not only how to handle the volatility smile but how to evaluate and build their own financial models.Topics covered The principles of valuation Static and dynamic replication The Black-Scholes-Merton model Hedging strategies Transaction costs The behavior of the volatility smile Implied distributions Local volatility models Stochastic volatility models Jump-diffusion models The first half of the book, Chapters 1 through 13, can serve as a standalone textbook for a course on option valuation and the Black-Scholes-Merton model, presenting the principles of financial modeling, several derivations of the model, and a detailed discussion of how it is used in practice. The second half focuses on the behavior of the volatility smile, and, in conjunction with the first half, can be used for as the basis for a more advanced course.

My Life as a Quant: Reflections on Physics and Finance by Derman, Emanuel 1st edition (2007) Paperback

by Emanuel Derman

Rating: 4.3 ⭐

Excellent Book

A Collection of Essays, Columns and Stories, 2012-2013.1. HUMAN AFFAIRSModels Behaving BadlyEagerness to Impart Unnecessary InformationMoney Changes EverythingThe Lives of OthersData Minding and the NSADoing The Things That He Wants ToPope and CircumstanceAmerican MisgivingsHorrible BossesAmerica LiteLeading From The FrontJust A New York Conversation2. FICTIONProstBoyhoodSeparation AnxietyMeetings with Remarkable WomenThe Noose3. MEN & WOMENFifty Shades of BlueDomesticityGender Surrenders4. FINANCE & MODELSThe Inevitable Lightness of Financial ModelingMisbehavioral PsychologyLittle Big DataIf You Can’t Be a Genius,Then Be Reliable Espequanto for BeginnersEMANUEL DERMAN is a professor at Columbia University, where he directs their program in financial engineering. His latest book is Why Confusing Illusion with Reality Can Lead to Disasters, On Wall Street and in Life, one of Business Week’s top ten books of 2011. He is also the author of My Life As A Quant, also one of Business Week's top ten of 2004, in which he introduced the quant world to a wide audience. He was born in South Africa but has lived most of his professional life in Manhattan, where he has made contributions to several fields. He started out as a theoretical physicist, doing research on unified theories of elementary particle interactions. At AT&T Bell Laboratories in the 1980s he developed programming languages for business modeling. From 1985 to 2002 he worked on Wall Street, running quantitative strategies research groups in fixed income, equities and risk management, and was appointed a managing director at Goldman Sachs & Co. in 1997. The financial models he developed there, the Black-Derman-Toy interest rate model and the Derman-Kani local volatility model, have become widely used industry standards.In his 1996 article Model Risk Derman pointed out the dangers that inevitably accompany the use of models, a theme he developed in My Life as a Quant. Among his awards and honors, he was named the SunGard/IAFE Financial Engineer of the Year in 2000. He has a PhD in theoretical physics from Columbia University and is the author of numerous articles in elementary particle physics, computer science, and finance.

Brief Hours and Weeks is the author's account of growing up in a small, tightly knit, first-generation Polish-Jewish community in Cape Town in the 1940s, 50s, and 60s.Observing through at first naive and then later more sophisticated eyes, he describes his childhood and youth in a protective off-the-boat immigrant Jewish family in very British-Commonwealth South Africa as apartheid becomes increasingly coercive.Through vivid and candid personal stories, he brings to life a time, place, culture, people, and set of mores that no longer exist. At 21, he leaves Africa to study in America.

Models.Behaving.Badly.: Why Confusing Illusion with Reality Can Lead to Disaster, on Wall Street and in Life by Emanuel Derman

by Emanuel Derman

Rating: 5.0 ⭐

Models. Behaving. Badly.: Warum die Verwechslung von Theorie und Wirklichkeit zum Desaster führt - im Leben und am Finanzmarkt

by Emanuel Derman

"Ein Grenzgänger und profilierter Vermittler zwischen der Welt der Formeln und der Welt der Kultur." Frank Schirrmacher über Emanuel DermanIn seinem bahnbrechenden Werk erklärt Emanuel Derman, warum Menschen anders - und zwar unvorhersehbar - agieren als Atome und Planeten und warum aus kleinen Irritationen, die sie verursachen, Chaos von gigantischen Ausmaßen entstehen kann. Finanzmodelle funktionieren nur unter eingeschränkten Bedingungen, nämlich wenn die Welt sich nicht allzu sehr verändert und nicht allzu weit von ihrem aktuellen Zustand abweicht. Und sie scheitern kläglich, sobald sie aus dem Ruder läuft. "Ihr iPad funktioniert, weil irgendjemand die Grundlagen der Quantenphysik verstanden hat und etwas bauen kann, das tut, was Sie wollen, wenn Sie einen Knopf drücken. Quantitative Finanzmarktanalysten benutzen die gleiche Art von Mathematik, um das eigenwillige Gebaren der internationalen Finanzmärkte zu beschreiben. In der Theorie sieht das alles schön überschaubar aus, doch in Wirklichkeit handelt es sich um eine vage Analogie, die in die Irre führt, weil sie behauptet, Aktienkurse verhalten sich wie die Ausbreitung von Dampf. Das ist keine Beschreibung der Wirklichkeit."

Models. Behaving. Badly. by Emanuel Derman (2013) Hardcover

by Emanuel Derman

Excellent Book

宽客人生:从物理学家到数量金融大师的传奇

by Emanuel Derman

宽客人生:从物理学家到数量金融大师的传奇简介:装订方式:平装书号:9787111517078作者:[美] 伊曼纽尔·德曼(Emanuel Derman) 著,韩冰洁 等译出版社:机械工业出版社出版时间:2015年11月分类管理|创业企业与企业家|企业家加微信(soweinc)和来自全球的书友一起学习交流.并且微信好友低至5折.

My Life asa QuantReflections onPhysics and Finance

by Emanuel Derman

My Life as a Quant Reflections onPhysics andFinance

by Emanuel Derman

Brief Hours and Weeks: My Life as a Capetonian

by Emanuel Derman