Charles D. Ellis

Charles “Charley” D. Ellis is an American investment consultant. In 1972, Ellis founded Greenwich Associates, an international strategy consulting firm focused on financial institutions. Ellis is known for his philosophy of passive investing through index funds, as detailed in his book Winning the Loser’s Game.

28 Books Written

Winning the Loser's Game: Timeless Strategies for Successful Investing, Eighth Edition

by Charles D. Ellis

Rating: 4.1 ⭐

• 2 recommendations ❤️

The definitive guide to long-term investing success―fully updated to address the realities of today’s marketsTechnology, information overload, and increasing market dominance by expert investors and computers make it harder than ever to produce investing results that overcome operating costs and fees. Winning the Loser’s Game reveals everything you need to know to reduce costs, fees, and taxes, and focus on long-term policies that are right for you.Candid, short, and super easy to read, Winning the Loser’s Game walks you through the process of developing and implementing a powerful investing strategy that generates solid profits year after year. In this eagerly awaited new edition, Charles D. Ellis applies the expertise developed over his long, illustrious career. This updated edition Companies change, and markets and economies go up and down―sometimes a lot.But the core principles of successful investing never change―and never will. That’s why, when you’ve read this book, you’ll know all you really need to know to be successful in investing.With Winning the Loser’s Game , you have everything you need to identify your unique investment objectives, develop a realistic and powerful investment program, and drive superior results.

The evidence-based approach to a more worthwhile portfolio The Index Revolution argues that active investing is a loser's game, and that a passive approach is more profitable in today's market. By adjusting your portfolio asset weights to match a performance index, you consistently earn higher rates of returns and come out on top in the long run. This book explains why, and describes how individual investors can take advantage of indexing to make their portfolio stronger and more profitable. By indexing investment operations at a very low cost, and trusting that active professionals have set securities prices as correctly as possible, you will achieve better long-term results than those who look down on passive approaches while following outdated advice that no longer works."Beating the market" is much harder than it used to be, and investors who continue to approach the market with that mindset populate the rolls of market losers time and time again. This book explains why indexing is the preferred approach in the current investment climate, and destroys the popular perception of passive investing as a weak market strategy.Structure your portfolio to perform better over the long term Trust in the pricing and earn higher rates of return Learn why a passive approach is more consistent and worthwhile Ignore overblown, outdated advice that is doomed to disappoint All great investors share a common secret to rational decision-making based on objective information. The Index Revolution shows you a more rational approach to the market for a more profitable portfolio.

The jury is still out on what the future of Goldman Sachs will look like, but no one can argue that the 139 year old firm has been (and, if Warren Buffett has his way, will be) the dominant investment banker and dealer on Wall Street. What does Buffett see that we on the outside do not? It’s all about the people. Charles D. Ellis has written a landmark book that couldn’t come at a better time. The Partnership: The Making of Goldman Sachs is the colorful and fascinating story of Goldman’s rise to power through many life-threatening changes in markets, competition, and regulation. It tells the personal history of the men and women who built the world’s leading financial powerhouse from a firm that was disgraced and nearly destroyed in 1929, limped along as a break-even operation through the Depression and WWII, and, with only one special service and one improbable banker, began the rise that, in half a century, took Goldman Sachs to global leadership. A conversation with Charles Ellis: * Is Goldman Sachs really a lot better than other firms at managing risk? The big difference is in the cumulative power of many “small” details. The difference in the speed, accuracy, and extent of communication inside the firm; the difference in intensity, focus, and disciplined toughness of the men and women hand selected to work there and real difference in recruiting, training, and compensation. All add up to a decisive advantage in management. Leaders and co-leaders manage Goldman’s many business units with rigor and drive; risk management is the envy of other banks; and coordination is powerful across business units and markets around the world. As every Olympic athlete knows, such small differences make all the difference between gold, silver or bronze – or no medal at all. In the current, very difficult test, Goldman Sachs has come in 1st – again. * Goldman Sachs is often described as the best managed Wall Street firm. Is that true? Yes, it is true. Goldman Sachs is the best managed “Wall Street” firm – and the best led. Management is why Goldman Sachs is consistently rated the best firm to work for and gets top ratings from clients all over the world. Superior management is why the firm earns more profit, develops more effective people, has made itself the market leader in the U.S., U.K, Germany, France, China, Japan, and in most major lines of banking business. No other firm comes close. One of the things you will learn in The Partnership is just how Goldman succeeded in making themselves different from any other Wall Street firm. They learned early on that in order to survive, they had to not only make money, but create a culture that was universal, that demanded absolutely loyalty and, most importantly, act as one organism. * Why does Goldman Sachs put so much weight on its “culture”? Goldman Sachs culture works. In the complex, fast-changing, global, 24/7 securities business almost all the important decisions are made in highly specific and complex settings under great time pressure. These decisions cannot be made by headquarters and they cannot be deferred. They must be made locally by local market and business experts thousands of times every day. Rules won’t work. If rules were written for every type of decision in all those different businesses in all the world’s different markets in all the different cultures, the resulting Rule Book would be far too large and complex to read or use. Culture – its way of working – is the universal “stem cell” that enables Goldman Sachs to operate so forcefully in so many different national markets and in so many different businesses. * With all its different business activities all over the world, doesn’t Goldman Sachs have problems with conflicts of interest? Yes! The firm certainly has many, many conflicts of interest. While it could take a defensive approach and try to avoid or minimize those risks of conflicts, the firm believes the more realistic and effective approach is to recognize those risks, be candid about them with clients and counterparties, and actively manage the conflicts. The firm strives to deal with each of them in such thoughtful and effective ways that clients and customers will know Goldman Sachs can be trusted to manage conflicts better than any other firm. This is, of course, an assumption of enormous responsibility – particularly on the scale on which Goldman Sachs operates – so it raises the obvious next question: Who will watch the watcher?

Go inside the elite investment firm with Capital . The Capital Group is one of the world?s largest investment management organizations, but little is known about it because the company has shunned any type of publicity. This compelling book, for the first time, takes you inside one of the most elite and private investment firms out there?the Capital Group Companies?a value investment firm par excellence. It digs deeps to reveal the corporate culture and long-term investment strategies that have made Capital the one organization where most investment professionals would like to work and would most recommend as long-term investment managers for their family and friends.

Rethinking Investing: A Very Short Guide to Very Long-Term Investing

by Charles D. Ellis

Rating: 3.8 ⭐

Sophisticated, simple “Bible” for long-term investors, especially those in or approaching retirementIn just 10 short, accessible, and inviting chapters, Rethinking A Very Short Book on Very Long-Term Investing presents straightforward steps that ordinary people can take to better invest their money. This book dispels myths about the value of investment managers, highlights emotional tendencies that can cloud our financial judgment, explains why index funds are a savvy choice, and reveals secrets like why it’s better to wait until age 70 to receive Social Security benefits—along with the calculations that make this decision crystal-clear.Written by renowned investor and popular author Charley Ellis, this must-read resource shows you how to set yourself up for investment success in three easy steps, with information Creating an optimal nest-egg withdrawal strategy to ensure you never run out of money, even if you live until age 100 Maximizing returns through tactics like reducing your tax bill and making full use of diversified investment vehicles Using a safe, passive investment strategy and letting the modern stock market do all of the hard work for you Rethinking A Very Short Book on Very Long-Term Investing is an essential read for long-term investors who want to start getting more from their money, especially those in or approaching retirement seeking to secure happier outcomes later in life.

What It Takes: Seven Secrets of Success from the World's Greatest Professional Firms

by Charles D. Ellis

Rating: 3.7 ⭐

Expert insights on what sets the great professional firms apart from all the rest Having devoted a career that spans fifty years to consulting with and studying professional firms in the Americas, Asia, and Europe, author Charles Ellis learned firsthand how difficult it is for an organization to go beyond very good and attain, as well as sustain, excellence. Now, he shares his hard-won insights with you and reveals "what it takes" to be best-in-class in any industry.Enlightening and entertaining, What It Takes explores firms that are leaders in their particular field and the superior people who create and maintain them. Along the way, it identifies the secrets of their long-term success and reveals exactly how they can put your organization in a better position to excel when properly executed.Contains many stories of achieving excellence, and addresses the obstacles that top-ranking organizations face in sustaining it Includes insights on leaders in their particular field--from McKinsey & Company in consulting and Cravath, Swaine & Moore in law to the Mayo Clinic in healthcare Written by one of the most experienced and respected business consultants/advisors of our time What It Takes skillfully shows you how innovation and a commitment to excellence can drive success, while also revealing how easy it is to fall behind. With it, you'll discover what separates the great firms from the good ones and learn how to attain, and maintain, organizational success throughout the years.

The United States faces a serious retirement challenge. Many of today's workers will lack the resources to retire at traditional ages and maintain their standard of living in retirement. Solving the problem is a major challenge in today's environment in which risk and responsibility have shifted from government and employers to individuals. For this reason, Charles D. Ellis, Alicia H. Munnell, and Andrew D. Eschtruth have written this concise guide for anyone concerned about their own - and the nation's - retirement security.Falling Short is grounded in sound research yet written in a highly accessible style. The authors provide a vivid picture of the retirement crisis in America. They offer the necessary context for understanding the nature and size of the retirement income shortfall, which is caused by both increasing income needs-due to longer lifespans and rising health costs-and decreasing support from Social Security and employer-sponsored pension plans.The solutions are to work longer and save more by building on the existing retirement system. To work longer, individuals should plan to stay in the labor force until age 70 if possible. To save more, policymakers should shore up Social Security's long-term finances; make all 401(k) plans fully automatic, with workers allowed to opt out; and ensure that everyone has access to a retirement savings plan. Individuals should also recognize that their house is a source of saving, which they can tap in retirement through downsizing or a reverse mortgage.

Inside Vanguard: Leadership Secrets From the Company That Continues to Rewrite the Rules of the Investing Business

by Charles D. Ellis

Rating: 4.0 ⭐

This rare intimate look at the world’s fastest growing investment manager provides invaluable lessons for investors and business leaders.One of the world’s largest and most trusted investing institutions, Vanguard serves over 30 million clients, manages more than eight trillion dollars, and is an influential industry disruptor.Now, Charles D. Ellis―referred to by Money magazine as “Wall Street’s wisest man”―reveals the story behind Vanguard’s rise to the top of the investing world. Provided unprecedented access to Vanguard’s leaders, Ellis explains why Jack Bogle started Vanguard and how he and his successors developed it into an investment industry disrupter that became the global leaderEllis includes in-depth interviews with the executives and key leaders of Vanguard, clear takeaways and lessons from their experiences, a primer on ETFs, and Jack Brennan’s Leadership Principles. From the emergence of index funds to the success of exchange-traded funds, Inside Vanguard is a near-Shakespearian drama of individual human struggle and triumph.

The Investor's Anthology: Original Ideas from the Industry's Greatest Minds

by Charles D. Ellis

Rating: 4.0 ⭐

In what feels like a series of personal audiences, Warren Buffett, John Templeton and dozens of others share the experiences of lifetimes in the market. Reach into this jewel box of an anthology and you will come up with gems of wit, wisdom, and analysis that reflect a unique combination of experience and insight in the essential elements that investing, like life itself, requires.

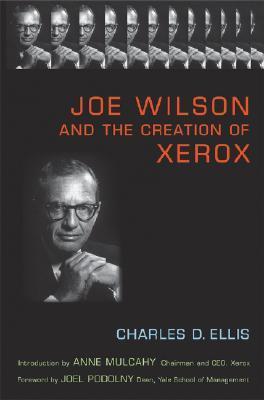

"Charley Ellis has written a magnificent portrait, capturing the indomitable spirit of Joe Wilson and his instinctive understanding of the need for and commercial usefulness of a transforming imaging technology. Joe Wilson and his extraordinary team, which I had the good fortune to first meet in 1960, epitomized the wonderful observation of George Bernard Shaw who said, 'Some look at things that are, and ask why? I dream of things that never were and ask why not?' Xerox and xerography are not only a part of our vocabulary, but part of our everyday life. Charley Ellis gives the reader a poignant understanding of just how this happened through the life, adventures, critical business decisions, and dreams of Joseph Wilson and a cadre of remarkable individuals. This book will surely join the library of memorable biographies that capture the building of America into a risk-tolerant, technologically sophisticated, idea-oriented society that thrives by understanding what Charles Darwin really 'Survival will be neither to the strongest of the species, nor to the most intelligent, but to those most adaptable to change.'"―Frederick Frank, Vice Chairman, Lehman Brothers Inc.

The evidence-based approach to a more worthwhile portfolio The Index Revolution argues that active investing is a loser's game, and that a passive approach is more profitable in today's market. By adjusting your portfolio asset weights to match a performance index, you consistently earn higher rates of returns and come out on top in the long run. This book explains why, and describes how individual investors can take advantage of indexing to make their portfolio stronger and more profitable. By indexing investment operations at a very low cost, and trusting that active professionals have set securities prices as correctly as possible, you will achieve better long-term results than those who look down on passive approaches while following outdated advice that no longer works. "Beating the market" is much harder than it used to be, and investors who continue to approach the market with that mindset populate the rolls of market losers time and time again. This book explains why indexing is the preferred approach in the current investment climate, and destroys the popular perception of passive investing as a weak market strategy. All great investors share a common secret to rational decision-making based on objective information. The Index Revolution shows you a more rational approach to the market for a more profitable portfolio.

Classics: An Investor's Anthology and Classics II: Another Investor's Anthology, by Charles Ellis. Charlie Ellis edited these two books in 1989 and 1991. They are out of print now, so you may need to visit a used book dealer or your local library in order to find them. Your search would be well worth the effort, however, because these two books provide a treasure trove of short articles written by the best investors and financial authors of all time--luminaries such as Paul Cabot, Benjamin Graham, David Dodd, T. Rowe Price, John Burr Williams, David Babson, Peter Bernstein, Phil Fisher, Harry Markowitz, Warren Buffett, William Sharpe, David Dreman, John Templeton, and many others. There is more wisdom contained in these two books than most investors are apt to encounter in a lifetime of personal investing experience, and if there is a better collection of important investment writings, I haven't found it. As they say on television infomercials, it would take a long time and cost a small fortune to duplicate this collection of the most memorable writings from many of the finest minds in investing. If you can't find these books, consider Ellis' similar, more abbreviated book, The Investor's Anthology (reviewed below).

The first complete Who's Who in the history of the world's best-known financial streetCharles D. Ellis and James R. Vertin have crafted a window on Wall Street that investors won't want to miss. These two Wall Street insiders provide detailed profiles of dozens of the most fascinating, influential, and talked-about financial luminaries ever to light up the dark and cavernous purlieus of the world's most famous street. Related here are intriguing tales of money won and lost, amazing coups, brazen cons of financial brilliance, and untrammeled greed and blind ambition. This compelling series includes profiles of the biggest names Alan Greenspan, Warren Buffett, Larry Tisch, Jim Rogers, Sanford Weill, and George Soros-as well as investment losers like Ivan Boesky and Nicholas Leeson.Charles D. Ellis (Greenwich, CT) is a Managing Partner of Greenwich Associates, the international financial consulting firm. Now fully retired, James R. Vertin (Menlo Park, CA) was a principal of Alpine Counselors, a financial consulting firm.

Winning the Loser's Game: Timeless Strategies for Successful Investing, Eighth Edition

by Charles D. Ellis

Rating: 4.4 ⭐

Technology, information overload, and increasing market dominance by expert investors and computers make it harder than ever to produce investing results that overcome operating costs and fees. Winning the Loser's Game reveals everything you need to know to reduce costs, fees, and taxes, and focus on long-term policies that are right for you.Candid, short, and accessible, Winning the Loser's Game walks you through the process of developing and implementing a powerful investing strategy that generates solid profits year after year. In this eagerly awaited new edition, Charles D. Ellis applies the expertise developed over his long, illustrious career. This updated edition new chapters on bond investing, how investor behavior affects returns, and how technology and big data are challenging traditional investment decision; new research and evidence supporting the case for indexing investment operations; and new insights into the role of governance, developing a comprehensive saving strategy, and the power of regression to the mean.Companies change, and markets and economies go up and down - sometimes, a lot. But the core principles of successful investing never change - and never will. That's why, when you've listened to this book, you'll know all you really need to know to be successful in investing.

Ninety-eight short studies of the entire book of Isaiah. The Wells of Salvation underlines the greatness of God and encourages us to rejoice in his victory.

Figuring It Out: Sixty Years of Answering Investors' Most Important Questions

by Charles D. Ellis

Rating: 2.8 ⭐

An indispensable collection of essays from one of the investment world’s leading lightsIn Figuring It Answers to the Most Difficult Investment Questions, world-renowned investing and finance guru Charles D. Ellis delivers a robust collection of incisive essays on an array of perennial and contemporary investing issues, from the rise and fall of performance investing to a compilation of essential investing guidelines.In the book, you’ll also find eye-opening discussions Whether bonds are an appropriate investment vehicle for long-term investors The costs of excessive liquidity in the typical portfolio The characteristics of successful investment firms, and how to spot themA can’t-miss resource for the everyday retail investor, author Charles Ellis draws on a lifetime of distinguished client service in the financial markets to reward readers with common-sense and accessible advice that deserves to be followed by anyone with an interest in maximizing their investment returns over the long haul.

Revealing, captivating, and surprising stories of yesterday's legendary financial masterminds From its inception, Wall Street has been home to a variety of fascinating heroes and villains who have left their mark-for better or for worse-in pursuit of their financial endeavors. In Volume Two of Wall Street People, Charles Ellis and James Vertin turn back the clock to reveal the true stories of yesterday's barons of finance. This book profiles some of the most interesting, powerful, and talked-about financial luminaries of the nineteenth and twentieth centuries. Readers will go behind the public image of financial personalities such as Jesse L. Livermore, Joseph P. Kennedy, Andrew Carnegie, and John D. Rockefeller. Vivid portraits of these and other financial legends offer a rare glimpse into the professional and personal world of yesterday's barons of finance. Charles D. Ellis (Greenwich, CT) served for twenty-eight years as Managing Partner of Greenwich Associates. James R. Vertin (Menlo Park, CA) was the founding manager and CIO of Wells Fargo Investment Advisors. Vertin and Ellis have previously collaborated to produce three other books, including Wall Street True Stories of Today's Masters and Moguls ( 0-471-23809-0).

Short studies on almost 200 passages from the Bible, from Genesis to Revelation. In each case the teaching of Scripture is related to marriage and the home.

When Raymon Platt Jr. stepped out of jail, he couldn’t have imagined the opportunity awaiting him. A trip to New York city soon reveals an unknown relative with a large inheritance to give away. But before Raymon can truly become rich, he must agree to playing a game, complete with stipulations and rules. And with only 30 days to spend 500 million dollars, Raymon’s character is put to the test by love, jealously, and greed. Raymon scrambles to succeed while avoiding sabotage and tricky obstacles at every turn. A familiar tale receives a fresh twist in this urban adventure of rags-to-riches. Will he achieve his goal, find love, lose old friends, or return to poverty flat broke? Only one way to find out. Follow Raymon and his crew as he attempts to beat the odds and Blow Money Fast.

本タイトルには付属資料・PDFが用意されています。ご購入後、デスクトップのライブラリー、またはアプリ上の「目次」でご確認ください。(アプリバージョン:Android 2.40以上、iOS 3.11以上) 世界100万部の超ロングセラー。資産運用の常識を変えた伝説の一冊!「市場と投資の本質」を伝える投資哲学の名著として、世界中で読み継がれてきたベストセラーを、最新データに基づき全面リニューアル。変動するマーケットに一喜一憂する。じっくり考えて決めた投資計画を無視して、高値で買い安値で売ってしまう。そんな経験をしたことがある方は少なくないでしょう。では、市場動向に左右されることなく、大切な資産を守り、実り豊かな人生を実現するには、どうすればいいのでしょうか? 本書ではその現実的な対応を教えます。著者のエリス氏は、投資の成功は、値上がり株を見つけることでも、ベンチマーク以上の成績を上げることでもなく、「自ら取り得るリスクの限界の範囲内で、長期的な投資計画や資産配分方針を入念に策定し、市場の動向に左右されず、徹底的にその方針を守り抜く」ことだと言います。そのための方法として詳しく紹介するのが、「インデックス・ファンド」への投資です。本書では、個人投資家が押さえるべき運用基本方針のポイント、成功する投資信託や確定拠出年金の選び方、投資の基本原則などについても広く解説。プロ・アマ問わず投資に関わる全ての人に広く役に立つ内容になっています。■改訂のポイント今回の改訂では最新データに基づき全面リニューアル。新たに6章を加え、2020年の新型コロナウイルスの蔓延がもたらした大暴落と急回復期など、最新の市場動向もふまえて内容をアップデートしています。

Balkan Languages

by Charles D. Ellis

A Summer In Normandy With My Children

by Charles D. Ellis

This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Shakspeare and the Bible. Shakspeare, a Reading From the Merchant of Venice; Shakspeariana;

by Charles D. Ellis

This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Utah, 1847 to 1870

by Charles D. Ellis

This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Haisha No Gēmu: Naze Shisan Un'yō Ni Katenainoka

by Charles D. Ellis

Institutional Investing

by Charles D. Ellis

Pensa al tuo futuro: Una guida essenziale agli investimenti di lungo termine

by Charles D. Ellis

Una guida essenziale per costruire un solido futuro finanziario, grazie a strategie collaudate, investimenti sicuri e un’oculata gestione patrimoniale.Con uno stile chiaro e accessibile, l’autore smonta i miti più diffusi relativi al mondo dei gestori di fondi, evidenzia le trappole emotive che spesso compromettono le nostre decisioni economiche e offre consigli pratici per gli investitori orientati al lungo termine.In dieci capitoli sintetici e ricchi di contenuti, il libro offre soluzioni pratiche per massimizzare i rendimenti, ridurre la pressione fiscale e sfruttare al meglio i principali strumenti di investimento.Ellis spiega perché gli ETF e i fondi indicizzati sono scelte intelligenti per ogni portafoglio e illustra alcune efficaci strategie operative per pianificare in modo efficiente i prelievi durante la pensione, con l’obiettivo di far durare il patrimonio anche fino ai 100 anni.'Pensa al tuo futuro' è una lettura imprescindibile per chi desidera far fruttare al meglio i propri un riferimento indispensabile per chi è già in pensione o si sta preparando a questa nuova fase della vita e vuole affrontarla con maggiore consapevolezza e serenità.

![敗者のゲーム[原著第8版] by チャールズ・エリス, 鹿毛 雄二, et al.](https://m.media-amazon.com/images/S/compressed.photo.goodreads.com/books/1682687920i/143654325.jpg)